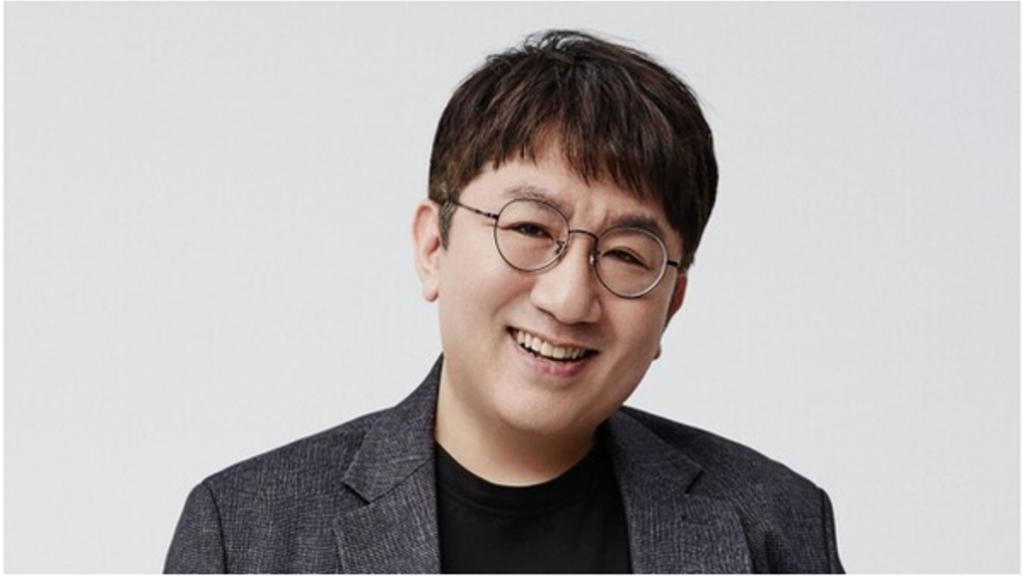

Teach Credit: Bang Si-hyuk, Chairman of Hybe’s board of directors

Online fraud South Korean financial authorities are filing criminal charges against Hybe chairman Bang Si-hyuk for alleged faux trading.

Per financial authorities on Wednesday, South Korea’s Capital Market Investigation Overview Committee made the decision to file a criminal criticism against Hybe chairman Bang Si-hyuk. The charges, due to be filed subsequent week, come amid allegations of faux trading beneath the Capital Markets Act.

The committee, a deliberative physique beneath the Securities and Futures Rate of the Financial Services and products Rate, is scheduled to take care of a frequent meeting on July 16 to direction of the agenda. “We seen the must carry a severe survey as Bang straight violated the Capital Markets Act,” acknowledged an official from the financial authorities.

Industry sources indicate that sooner than Hybe’s itemizing in 2020, Bang signed a contract with a non-public fairness fund established by his acquaintance to portion 30% of the income from stock sales. In doing so, he got around 400 billion won ($290~ million) in settlement after the itemizing.

These non-public fairness funds also bought Hybe shares from present merchants and venture capital firms. The financial authorities dangle reportedly secured proof that Bang’s side if truth be told handy present merchants that itemizing changed into currently impossible, however secretly pursued itemizing by purposes for designated audits.

Financial authorities suspect Bang pale non-public fairness funds to circumvent the “lock-up” duration, which prohibits most indispensable shareholders and executives from promoting shares for a definite amount of time after itemizing.

“Even if it takes a whereas, we can faithfully clarify that the itemizing on the time changed into performed in compliance with regulations and regulations,” acknowledged a Hybe representative.

Of gift, the contract between Bang and the non-public fairness funds changed into omitted from both the Korea Switch’s itemizing overview and the Financial Supervisory Service’s securities registration assertion submission direction of. That led to criticism that early merchants who sold Hybe shares with out this recordsdata suffered losses.