-

info@forensicss.com

Send Email

-

11400 West Olympic Blvd, Los Angeles, CA 90064

310-270-0598

Confidentiality Guaranteed

310-270-0598

Confidentiality Guaranteed

Blog Details

-

ForensicsS | Private Detective & Digital Forensics Investigation Experts > News > Investigations > Kenya sets up particular unit to fight growing ‘crypto’ fraud

Dec

Kenya sets up particular unit to fight growing ‘crypto’ fraud

Mobile forensics

Kenya’s prison intelligence agency has established a fresh particular unit to crack down on digital asset crime, which fee native traders over $43 million in 2024 and just isn’t always off route to hit a fresh account in 2025.

The Directorate of Prison Investigations (DCI) recently presented the fresh unit, which it says will habits a “ruthless” crackdown on ‘crypto’ fraudsters.

“We are forming a specialised unit to crack down on cryptocurrency fraud. The DCI is devoted to staying sooner than prison syndicates. As criminals migrate to digital areas that provide anonymity, regulation enforcement must always innovate with equal tempo,” mentioned Rosemary Kuraru, who heads the forensic lab on the DCI.

The agency moreover recently launched a fresh program that seeks to equip investigators with the abilities required to pursue ‘crypto’ criminals. Dubbed the “Blockchain and Cryptocurrency Investigation Coaching Module,” the route was once co-funded by the European Union.

It delved into “tracing and analysing blockchain transactions, investigating crimes connected to digital wallets and cryptocurrency exchanges, making use of international most productive practices in digital forensics and improving detestable-border cooperation to handle transnational digital crimes,” Kuraru mentioned.

The route introduced collectively officials from bigger than 10 African nations to be taught the most fresh methods in blockchain forensics and save practical skills with among the most developed tools used to observe digital resources.

Kenya’s ‘crypto’ crime skyrockets

DCI’s efforts advance amid a continued upward thrust in digital asset crime within the East African nation. An within picture, seen by native newspaper Day to day Nation, printed that Kenyans misplaced Sh5.6 billion ($43.3 million) in 2024 to ‘crypto’ fraudsters, a 73% spike from the year prior.

Within the first ten months of 2025, Kenyans possess already surpassed final year’s entire, one detective truly handy the paper. The figures are seemingly even bigger, on condition that nearly all of the crimes flow unreported.

Total, Kenyans misplaced $231.5 million to cybercrimes final year, putting Kenya amongst Africa’s supreme hubs for digital crime, Kuraru says.

“The proliferation of digital resources has introduced both opportunity and be troubled. While many Kenyans use cryptocurrency for remittances and as a change financial solution, thousands possess moreover fallen victim to fraudsters, losing billions of shillings,” she mentioned.

Authorities possess stepped up their clampdown on digital asset fraudsters, with dozens arrested this year.

Two months ago, two males had been arraigned in a Nairobi court docket for scamming $119,000 from a local businesswoman below the guise of a digital asset funding. Correct weeks earlier, four suspects had been arraigned within the same court docket for defrauding a Nairobi businessman of $100,000. The fraud is expanding beyond the capital, with one man arrested for a $30,000 rip-off in Nakuru, 100 miles northwest of Nairobi.

Within the previous three years, the DCI has dealt with over 500 digital asset-connected conditions.

‘Crypto’ crime is expanding beyond scamming. Remaining month, a businessman from Northern Kenya was once arrested on suspicion of the use of digital resources to finance terrorism. Weeks earlier, a lawyer from the coastal town of Mombasa had been arrested on identical costs.

This wave of ‘crypto’ crime has change into a bother for national safety agencies. In his Bid of Security picture, President William Ruto singled ‘crypto’ out as regarded as one of many well-known threats to the digital economy.

“Cybercriminals possess been exploiting cryptocurrency platforms for fraud, ransomware payments and nameless transactions, thereby fuelling cybercrime — a threat to our national safety,” he truly handy lawmakers.

$40 billion misplaced

The upward thrust in ‘crypto’ crime has mirrored Kenya’s skyrocketing digital asset adoption, with over six million Kenyans reportedly owning digital tokens. The scammers target beginners with claims of being buying and selling specialists who can ship outsized profits.

It moreover comes despite the inauguration of a comprehensive digital asset carrier provider (VASP) Bill that sooner or later legalizes digital asset job within the nation. The invoice requires all VASPs to be licensed, nonetheless the central bank says it has yet to bother any fresh licenses below the regime.

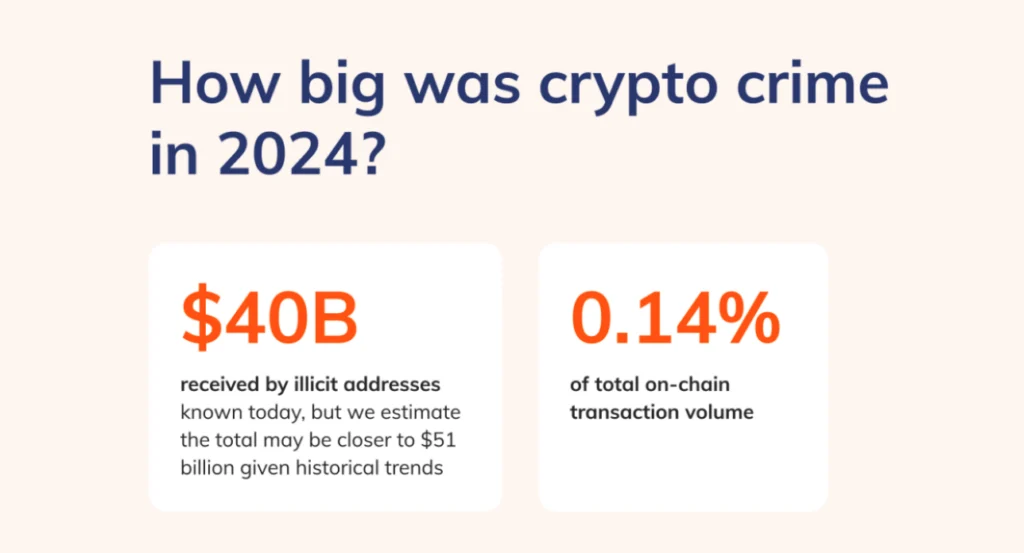

Globally, digital asset criminals stole over $40 billion in 2024, an investigation by Chainalysis printed. The loot accounted for 0.14% of all ‘crypto’ transactions.

Accept as true with about: Tech redefines how things are done—Africa is here for it

Tagged:

Tags

- cybercrime digital-forensics email-fraud forensics|digital-forensics Investigation investigationfraud Kenya malware online-scam online-scamphishing-attack private-detective scam|fraud private-eye cyber|cybersecurity private-eye phishing|phishing-attack private-investigator private-investigator hacking|hacker Special

Recent Posts

- Broker who supplied malware to the FBI space for sentencing

- High college senior going through extra than 300 prison fees in alleged sextortion map focusing on minors: reports

- 12 Delivery air Energy Tools You Can also objective accrued Appreciate In Your Garage Sooner than Spring Will get Right here

- How the FBI tracked down a Maryland man allegedly in the support of a secret-filming YouTube channel

- Hackers Raise The Fear About Discord’s Most recent Age-Verification Accomplice